Tri Polar World 3.0

As we begin a new decade it's a good time to both think through some recent Tri Polar World (TPW) developments and consider what the future might hold. From its NAFTA related origin over 25 years ago to its TPW 2.0 iteration post the 2008-9 Great Financial Crisis (GFC) through to Brexit, the Trump presidency and the US - China trade fight, the TPW construct has continued to evolve. Focused on regional integration in the three main regions of Asia, Europe & the Americas, it has been a useful way to think about geo politics, the world economy & financial markets.

More recently, the sharpening of US - China tech competition and the rapid rise of climate concerns have provided the outlines for the next phase of TPW’s evolution. These include “Splinternet” to describe the separation of tech into two distinct, US and China led camps, with Europe playing the role of regulator. There is also the growing web of issues around the cost- benefits of tech, ranging from privacy and data concerns to antitrust and digital tax issues. On the climate side, Europe is fast becoming the regional standard bearer for climate action as it becomes evident that climate change will not be dealt with globally (US to withdraw from the Paris Accord) nor locally as the smoke from the bushfires of Australia affecting New Zealand air quality illustrates.

Let's start with a review of the TPW construct, its origin, evolution and main drivers. From there we will discuss the addition of two new and potentially quite powerful drivers (tech & climate) before concluding with some thoughts about which region may emerge in the decade ahead (hint - it doesn't begin with an A) as we migrate to TPW 3.0, a true multi polar global economy. (See Chart One)

Chart 1: The Tri Polar World Today

Source: International Monetary Fund

TRI POLAR WORLD 1.0

Tri Polar World’s origins manifested in the early 1990s through the NAFTA Accord which brought together Mexico as a low cost production platform, the US as a demand center & Canada as a natural resources provider. Europe’s subsequent introduction of the Euro was both a competitive response & a recognition that one had to go big or go home. Thus Europe began to reorganize itself around low cost production in Eastern Europe, a demand center in Western Europe and a natural resource provider in Russia. Asia had yet to organize itself at this level and so it was more a bi polar world than tri polar.

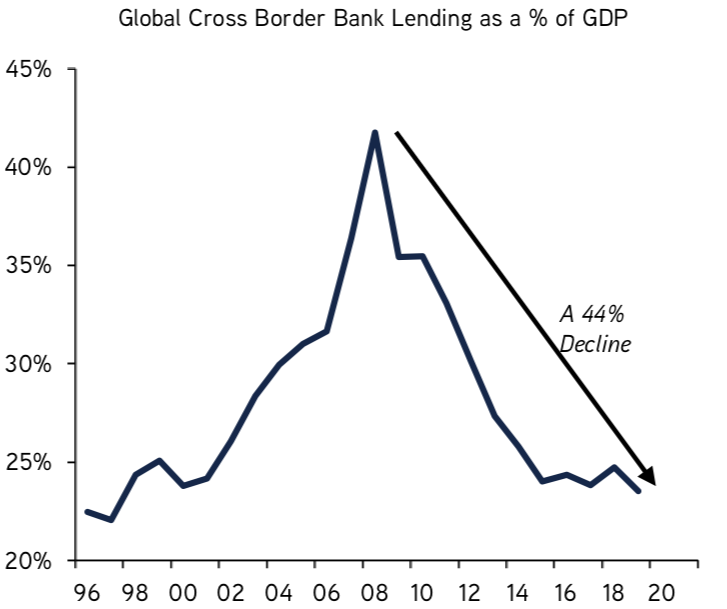

TPW’s next evolution came about in the wake of the GFC as a personal effort to develop a new paradigm for the global economy; one necessitated by the sudden break in what had appeared to be a US led unstoppable wave of globalization in the 1990s & 2000s. Finance, the tip of the globalization spear, went into reverse in the years after 2008-9 as capital flows slowed, banks pulled back from international expansion and policy makers relied almost solely on monetary policy to fight the resultant economic slowdown. This pullback continues: according to the UN, 2019 was the 4th year in a row of lower net global FDI flows, falling back to 2010 levels. ( See Chart 2)

Chart 2: 2009 Marks End of Globalization

Source: KKR, BofA Merril Lynch, Bloomberg as of 05.31.2019

If full throttle globalization was no longer viable and monetary policy was limited in its ability to help Main St as opposed to simply Wall St what would replace it? Roughly a decade ago I started to think through the answer to this question and developed the idea that regional deepening or regional integration in each of the three main regions: Europe, Asia and the Americas could be a possible solution. I called it the Tri Polar World (for more, please visit the “Approach” header for back history).

TRI POLAR WORLD 2.0

Underpinning TPW 2.0 was the idea that there were three new and mutually reinforcing drivers to this regional integration process: each region’s growing ability to one, self finance, through growing wealth pools, two, self produce, as advanced manufacturing, robotics, 3 D printing etc made it possible for each region to become its own production center and three, self consume, as urbanization, the rise of the service sector and of course, e commerce, led to each region’s ability to become its own consumer. One can see how each of the three drivers helps reinforce the others, thus driving regional integration.

Over the past half dozen years or so much of this has come to pass with the capital markets development in Asia, best epitomized by China, the corporate bond market expansion in Europe and the growing pools of capital in S America among other examples. At the same time, re-shoring became part of the headlines, not because of political desire though that has been visible in the US under Pres. Trump but because automation has led to falling costs of production in even high wage countries. Production may come back to the US and core Europe but manufacturing jobs per se will not as robots will do the work. (See Chart 3)

Chart 3: Manufacturing Now Made at Home ( By Robots)

Source: KKR, IMFWEO, Haver Analytics as of 07.09.2019

The real driver though has been the rise of e commerce and especially the rise of mobile shopping and payment most visible in China but increasingly evident across the EM, Europe and the US as well. This in turn led to next day and then same day delivery which itself led to surging demand for industrial warehouse space at the same time as it precipitated the collapse of the mall shopping experience. The rise of logistics, transport and many other subtends reinforced this process.

It is now almost axiomatic that one can see something one likes, order it via one’s phone and expect it on your doorstep by the end of the day - something unheard of just three years ago & a shopping experience very hard to fulfill if one is dependent on cheap labor production 3,000 miles away. Asia leads this process & today, headlines note how China tech and VC players are flooding SE Asia, looking to bring money and tech together to service the region’s vast and rapidly growing consumer market.

At the same time geopolitics were driving a similar awakening in political and policy circles - whether it be Brexit and the recognition that the EU needed to make the case for Europe (successfully by the way) or Pres. Trump’s election and subsequent desire to see NAFTA replaced. In a low growth world, it is perhaps not a surprise that the benefits of globalization are called into question while the costs are brought forward and highlighted. In a way it's also not a surprise that the US has led this questioning process given Europe’s large current account surplus and the role global demand has played in China’s economic miracle. The US decision to abandon the TransPacific Partnership (TPP) has provided China with an open lane to bind Asia together via its Belt & Road policy, further deepening Asian integration while the US focuses on America First. Implicit in the TPW construct is the belief that no country, not even the US, can go it alone and prosper.

US - CHINA DECOUPLING & CHAINED GLOBALIZATION

This last point provides a good segue into the US China trade dispute, now in a quiet period given the just signed Phase One deal but a dispute that is unlikely to be resolved any time soon. The real fight is not over the bilateral trade relationship but over who will lead the 21st century’s commanding technologies, namely 5 G and AI. The US has made it very clear that China can no longer count on US markets or even US parts to support its drive up the value added ladder, a drive that all countries must undertake, especially ones whose demographics are as unattractive as China’s. It is no surprise then that China has focused on self-reliance in the tech space - should the US extend the separation to include the financial realm one can expect China to do the same there as well with likely adverse consequences for the USD over the medium term. The growing US reliance on economic and financial sanctions is unlikely to be a permanent one way street.

Further US - China decoupling would greatly increase the risk that institutional and economic interdependence could be “weaponized” against those who have most fully embraced the globalization thesis on both a corporate as well as country level. That would seem to be mainly the US. A recent HBR article noted that new political risks are found in the heart of the global economy as business choke points are politicized (Huawei), implying that the very infrastructure that facilitates global business could become a source of risk rather than reward. Global networks of production and distribution might flip from economic & political pathways to a new set of chains - what some call “chained globalization”.

This is likely to have significant ramifications for investors across the world given that what had been winning corporate strategies: setting up R&D and production facilities in different countries around the globe now gets turned on its head as those assets risk becoming either stranded assets or worse potential hostages in a more nuanced conflict between states. Joint Ventures are likely to replace fully owned subs in different countries to protect both parties from adverse geopolitical risks. Local /regional companies from large countries with sizable domestic demand bases are likely to be the winners.

The implications are profound.

TECHNOLOGY - DRIVE TO SELF INNOVATE

The Tech fight suggests that each region’s growing ability and desire to control its own tech or what we posit as the ability to self innovate will be an important new driver to the TPW construct in the coming decade.

As Governments come under pressure to relieve Central Banks (peak CBs) and bring fiscal power to bear to support growth an important corollary will be to ensure that the fruits of tech success are maintained in country. Technology and the issues surrounding it: innovation, jobs, privacy, data, revenue, tax receipts etc is creating a new dynamic. China seeks to be Asia’s dominant tech player while the US works feverishly to keep it out of Europe; Huawei and its European 5 G aspirations is the most visible example of this effort. The US, which lacks its own 5 G champion, is trying to push European players to the fore even though they are more expensive and may not be cutting edge. To date, the US has very limited success blackballing Huawei with even its closest European allies not on board. A lack of success could backfire if US technology falls behind the other regions. China is likely to continue developing its own domestic tech ecosystem, perhaps even its own root system, cleaving off from the global Internet as we have known it.

Europe seeks to build off its leadership efforts in digital privacy (GDPR) to become the rules or standard setter for the two big players, China and the US. With Ms. Vestager as Digital and Competition Minister, the regulatory set up for AI is next on Europe’s list. Europe’s large population and lack of a dominant tech sector may give it more rule making power than one imagines at this point. US based Big Tech players confront a challenging landscape that seems at odds with their stock market success given that tech is now a larger share of the S&P index than at the height of the 1999-2000 tech bubble. Too big at home, where calls for antitrust breakups grow louder, too foreign abroad, US Big Tech is likely to face significant challenges in the decade ahead.

The research firm 13D has noted that 45 countries have some version of data localization requirements now in place and posits that countries face two options: to assert tech sovereignty or risk being colonized by foreign tech giants. India, where the Govt is anxious to ensure Indian demand and growth go to Indian companies which pay taxes in India, is a good example of future global competition. On the plus side, there is the intriguing prospect that regional tech ecosystems can leverage the TPW’s three existing drivers: self finance, produce and consume, thus accelerating & deepening the regional integration process.

CLIMATE - DRIVE TO SELF PROTECT

The second new driver is climate change or self-protection - climate, like tech, is a globe spanning issue that is unlikely to be solved at the global level (Paris Accord failure) and which is too great for any single country to determine. Thus the potential for it to be best handled on a regional level. Europe looks to be stealing a march on its regional competitors with its Green Deal & Sustainable European Investment Plan.

New European Commission leadership under Ms. van der Leyen has quickly laid out plans for a $1T program over the coming decade to completely transform Europe’s climate effort and get to net zero greenhouse gas emissions by 2050. The contrast with the US, where a Green New Deal plan was widely panned, is sharp. As Dylan sang you don't need a weatherman to know which way the wind is blowing. The current US Govt seems determined to row in reverse to what others are doing, not out of a better understanding of what's needed but out of political expediency, an approach that is likely to ultimately prove self-defeating.

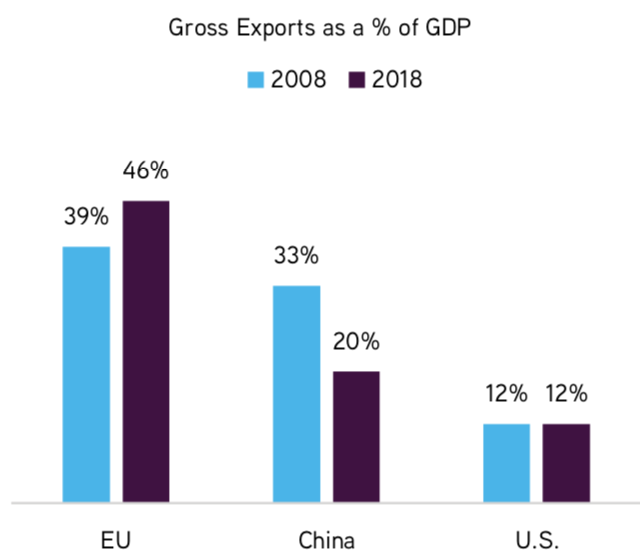

The beauty of Europe’s climate effort is that it can achieve several objectives under one plan: it can place Europe in the leadership position for climate change and all the adjustment that goes along with that in terms of new technology, standard setting, etc. In addition, it can help deepen regional integration by serving as source of region wide fiscal stimulus, something that has eluded Europe for a decade & more. It may also serve as a prod to some inflation while stimulating job creation & internal demand. Finally it takes the old Continent and makes it new, something to rally the youth around - no small thing given how many streets across the globe are filled with youthful protests. (See Chart 4)

Chart 4: Could Climate Change Stimulate EU Internal Demand?

Source: KKR, Eurostat, Bureau of Economic Analysis, State Admin of Foreign Exchange (China) and China National Bureau of Statistics

The more one thinks about it the more one can see how the shift to a carbon neutral global economy could be THE driving force for global growth in the coming decade. It is worth adding that the 2020s may also be a decade where the long wave of wealth concentration, visible in the US since the Reagan days, shifts to wealth distribution as Millennials take power in the voting box and in policy making.

Less wealthy, more indebted and sicker than their peers of previous generations, Millennials grew up in the shadow of 9/11, the Iraq War, the GFC etc and are not enamored by nor beholden to the traditional ways of doing things. The current US election process may give one a window into this generational shift with Millennial support for the Democratic Party’s Progressive wing growing in significant fashion. (See Chart 5)

Chart 5: From Wealth Concentration to Wealth Distribution

Source: The Economist, Board of Governors of Federal Reserve System (2017)

THE 2020s - EUROPE’S DECADE?

As we enter the 2020s then the TPW construct is evolving in a way that suggests regional deepening and regional integration in each of the three main regions will remain a useful way to think about the global economy. Asian integration is likely to be led by China, through its Belt & Road process, leveraging its wealth and tech power as well as its weight as the largest trading partner for its Asian neighbors.

The Americas seem adrift in both the US and in South America, with little in the way of unifying efforts. Interestingly enough this is not new - one can argue that since NAFTA the Americas have made little headway in thinking about, let alone activating, a regional integration strategy. The USMCA does not really advance the process to any appreciable degree.

Today, the US is focused on trying to fit its China competition into a new Cold War paradigm, an effort that is likely to be unsuccessful given how much more entwined the US and China are compared to the US and the Soviet Union of old. More importantly, the success of China’s state led economic model directly challenges the US view of linkage between capitalism and liberal democracy - something the Soviet Union never did. This competition even extends to education and human talent as offshore demand for US higher ed slumps, calling into question a key human element to US tech and innovation success. Failure to think about how to best integrate all the Americas and leverage the youth, demand and dynamism of the countries south of the border leaves the US at risk of falling behind the regional integration efforts of Asia and Europe. (See Chart 6)

Chart 6: The Downside of De Coupling

Source: KKR, Cushman Wakefield, The Financial Times as of 2018

The twin new drivers of technology and climate could offer Europe the opportunity to finally emerge from a tough decade & flip the script. Leveraging its nearly 600 million people and $16T economy, Europe has a chance to set the rules in both science & technology. Europe’s position as the balancer between Asia and the Americas ensures others will want to play by those rules in order to compete in the European market place.

After a decade of navel gazing Europe, under new leadership, seems ready to leverage its successes as a social market economy where some of the wealth distribution issues likely to confront both the Americas and Asia seem much more settled. Europe also benefits from the recognition that each state individually is too small to set its own course (the UK will be an interesting test bed). Perhaps most importantly, climate change is shaping up to be THE issue for the 2020s & Europe’s early adoption of the Green Deal could propel it forward suggesting that the coming decade could be the decade of Europe, following the Asian decade just ending (China ascendant) and the decade of the Americas at the turn of the century (Washington Consensus).

In a recent FT interview, German Chancellor Angela Merkel noted: “Europe can be a pole that takes on its share of responsibility in a multi polar world. That's how I see things.” Well said.

THE TRI POLAR WORLD & INVESTING

How does one factor the TPW construct into investment decision making? (See Chart 7) At TPWIM we use it as the starting point for how we think about the world; as such it helps lead us to differentiated points of view. It also highlights our ability to originate and communicate unique investment thinking. Currently we are thinking about tech and how and where we want to be positioned in that sector, considering how China benefits from the US trade fight, analyzing the potential for small caps to benefit from regional internal demand creation & considering the EM space given that the traditional middle income step of being a production center for the West is no longer viable. Perhaps EM can replace it with one thing EM has in abundance, eyeballs, and what that might mean for EM e commerce. Furthermore, it would seem for example that those EM companies, countries that are able to integrate more fully with their respective regions may well be best placed to perform.

Chart 7: The Tri Polar World in the Investment Process

Source: TPW Investment Management

It's important to note that we pair the TPW construct with our next level down analysis, what we call our Global Risk Nexus (GRN). This process analyzes economics, politics, policy and markets across each region and globally on a monthly basis & helps identify themes such as our Lower for Longer Global Growth Path, how that might lead to Higher for Longer Stock Prices and a Continued Search for Yield and more. For example, during 2019 our understanding of the Self-Produce and Self-Consume drivers guided us to focus on the health of the European and Asian service sectors rather than just the Manufacturing sector which in turn helped develop our Fall Risk Asset Rally call & positioning and the set up for our current outlook: Reflation 2020 ( link).

We anticipate the TPW will continue to evolve through the decade and beyond as Europe further develops its citizen centric model, implements the Green Deal, sets AI & climate standards and more; Asia utilizes its own capital & tech to integrate further and leapfrog decades of outmoded production and distribution setups and the Americas recognize that going it alone it unlikely to lead to success.

In researching and writing this piece what has really stood out is the importance of the climate challenge and opportunity. Acceptance of the need to get in the fight seems to have blossomed almost overnight after a long period of skepticism (such still reigns in the US). It seems likely that the region which grasps this challenge and opportunity most aggressively could well lead in the decade ahead. Given the speed of change, making predictions seems almost foolhardy yet if Europe keeps up its climate change pace it could well lead the way in the decade ahead. It is thinking like this that leads us at TPWIM to believe the TPW construct and process provides real value to our investment thinking. If you have gotten to this point we hope you feel the same way.

Jay Pelosky, CIO & Co-Founder

TPW Investment Management

DISCLOSURE:

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. Returns can vary dramatically in separately managed accounts as such factors as point of entry, style range and varying execution costs at different broker/dealers can play a role. The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts are inherently limited and should not be relied upon as an indicator of future results. There is no guarantee that these investment strategies will work under all market conditions, and each advisor should evaluate their ability to invest client funds for the long-term, especially during periods of downturn in the market. Some products/services may not be offered at certain broker/dealer firms.

There can be no assurance that the purchase of the securities in this portfolio will be profitable, either individually or in the aggregate, or that such purchases will be more profitable than alternative investments. Investment in any TPWIM Portfolios, or any other investment or investment strategy involves risk, including the loss of principal; and there is no guarantee that investment in TPWIM’s Portfolios, or any other investment strategy will be profitable for a client’s or prospective client’s portfolio. Investments in TPWIM’s Portfolios, or any other investment or investment strategy, are not deposits of a bank, savings and loan or credit union; are not issued by, guaranteed by, or obligations of a bank, savings and loan, or credit union; and are not insured or guaranteed by the FDIC, SIPC, NCUSIF or any other agency.

The investment descriptions and other information contained in this are based on data calculated by TPW Investment Management, LLC (TPWIM) and other sources including Bloomberg. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities.